Irs pay estimated taxes online 2021

You expect to owe at least 1000 in tax for 2021 after subtracting your withholding and refundable. You wont owe an estimated tax penalty if the tax shown on your 2022 return minus your 2022 withholding is less than 1000.

Irs Offers Multiple Ways To Pay

Quarterly tax payments should be made four times per year and the IRS does have guidelines or deadlines for these timeframes.

. Make estimated tax payments online with MassTaxConnect Individuals and businesses can make estimated tax payments electronically through MassTaxConnect. An estimated payment worksheet is available through your individual online services account to help you determine your estimated tax liability and how many payments you should make. Estimated tax is the method used to pay tax on income that isnt subject to withholding for example earnings from self.

They can also visit IRSgovpayments to pay electronically. Tom Wolf Governor C. Individual Payment Type options include.

These were as follows for 2021 Taxes these. The final quarterly payment is due January 18. 100 of the tax shown on your 2021 return.

If you are making an estimated tax payment for an estate or trust and have a fiduciary account log in to. The best way to. Form 1040-ES Estimated Tax for Individuals includes instructions to help taxpayers figure their estimated taxes.

Online file and pay file Form NC-40 and associated tax payment using the NCDOR website The deadline to file and pay your 2021 estimated taxes has passed. To avoid an Underpayment of Estimated Tax penalty be sure to make your payment on time. 1st Quarterly Estimated Tax Payment - July 15 2020 Was April 15 2020.

In most cases you must pay estimated tax for 2021 if both of the following apply. Aside from income tax taxpayers can pay other taxes through estimated tax payments. This includes self-employment tax and the alternative minimum tax.

Scheduling tax payments for 2020 and 2021 was a breeze In 2021 estimated taxes are due on April 15 June 15 September 15. View the amount you owe your payment plan details payment history and any scheduled or pending payments. Realty Transfer Tax Payment.

Estimated taxes are generally paid quarterly on April 15th. Make a same day payment from your bank account for your. Payment for Unpaid Income Tax Small Business.

Log in to or create your Individual Online Services account. Use Form 1040-ES to figure and pay your estimated tax for 2022. If you want to make a late estimated tax payment after January 31st for last year select Balance Due as the reason for payment.

Personal Income Tax Payment.

Estimated Tax Payments Youtube

Top 8 Irs Tax Forms Everything You Need To Know Taxact

How To Pay Federal Estimated Taxes Online To The Irs In 2022 Estimated Tax Payments Online Taxes Tax Help

Tax Filing 2021 Performance Underscores Need For Irs To Address Persistent Challenges U S Gao

How To Pay The Irs Online Pay Income Taxes Pay The Irs Taxes Online By Mail Pay 1040 Online Youtube

How To Get Irs Tax Transcript Online For I 485 Filing Usa

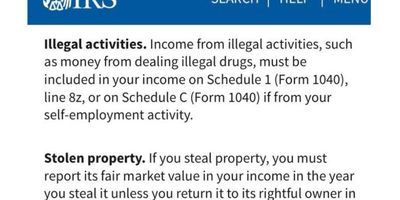

The Irs Says Criminals Have To Report Illegal Income Seriously Upworthy

Pin On Form W 8 Ben E

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

The Irs Has Sent Nearly 30 Million Refunds Here S The Average Payment

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Here S Why Actually The Irs 600 Bank Reporting Proposal Is Entirely Reasonable

Faqs On Penalty For Underpayment Of Estimated Tax Https Www Irstaxapp Com Faqs On Penalty For Underpayment Of Estimated Tax Tax Tax Deductions Coding

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

What To Do If You Receive A Missing Tax Return Notice From The Irs

Pin On Hhh